Posted on: 27 Oct 2020

Here's Why A 1% Difference In Your Home Loan Matters!

"Don't underestimate how much savings you can get from a refinance. Be sure to consult our experienced team of lenders to check if a refinance benefits you today." - Catherine Mapusua, General Manager

Are you paying the lazy tax? Whether it’s your electricity bill, phone plan or car insurance, it can be so easy to stick with the same provider and plan year after year - especially if you think you’re getting a good deal.

But complacency costs, particularly when it comes to home loans.

We can find the best deals for your specific situation! Refinance today!

In recent years home loan rates have plummeted, yet according to a recent Mozo analysis only 6% of mortgage holders (roughly 320,000 people) had refinanced their home loans in the 12 months to June 2020.

Why is that an issue? If you haven’t refinanced recently, chances are that the rate you're on hasn’t kept pace with the sharpest home loan offers on the market, meaning you could be missing out on some serious savings. Let’s break it down.

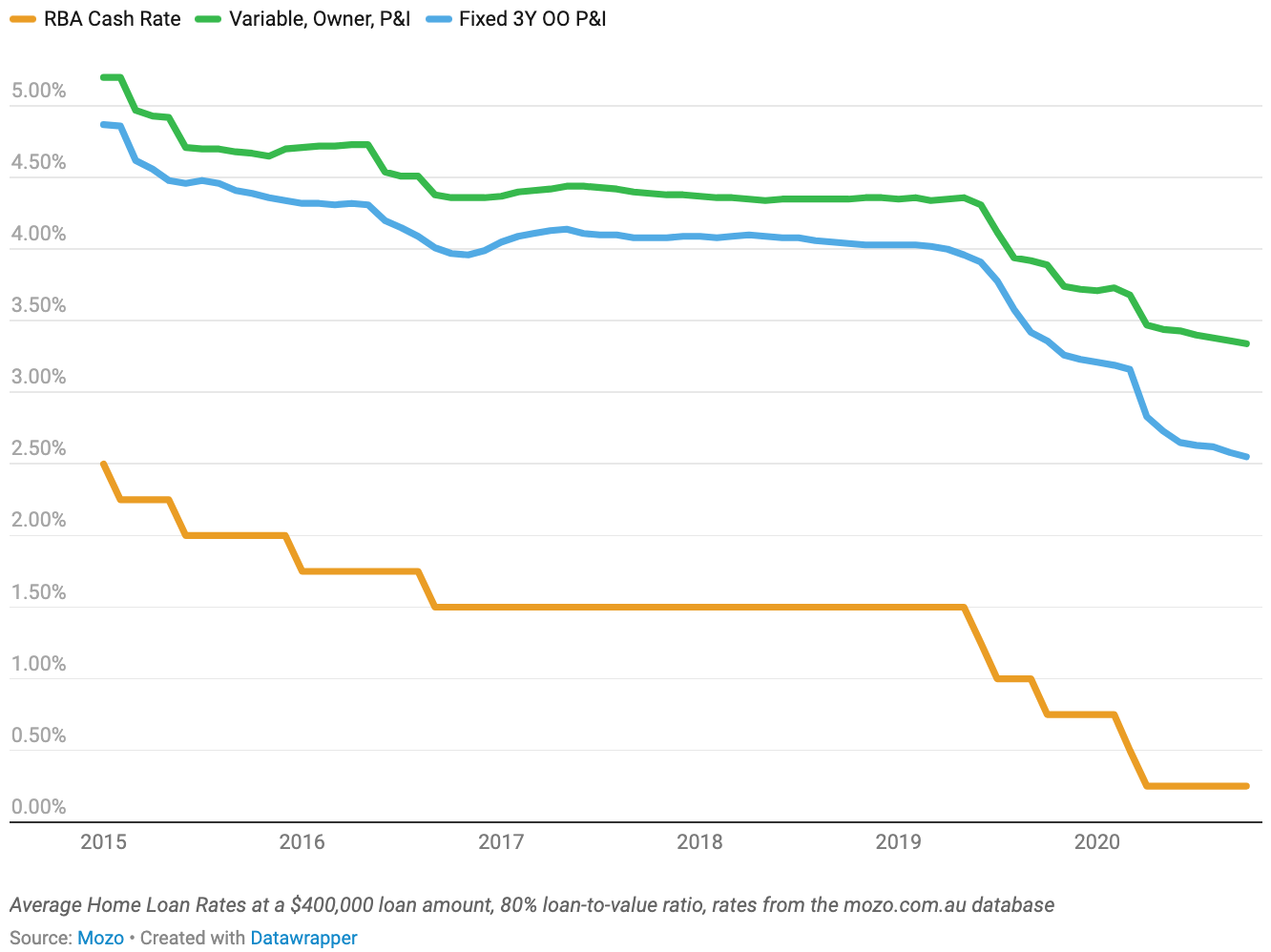

Since June 2019, the Reserve Bank has cut interest rates five times, resulting in a drop in the official cash rate from 1.50% to 0.25%. And as the graph above shows, lenders have largely followed suit.

According to our latest home loan statistics, the average variable rate for owner-occupiers in the Mozo database has dropped by over 1.00% in just two years. And the average 3-year fixed rate for owner-occupiers has fallen by an even greater amount.

Of course, those are just average rates. There are much lower rates on offer, as a handful of variable rates have dropped below the 2.50% mark in recent months while plenty of fixed rates have dipped under 2.20%.

How much could you save with a 1% cut?

Now that you’re up to speed with how far home loan interest rates have fallen, you’re probably wondering what sort of difference a substantial cut could make to your own loan repayments?

Depending on your current rate, and the size of your loan, it could be a big one - we’re talking about monthly savings in the hundreds of dollars.

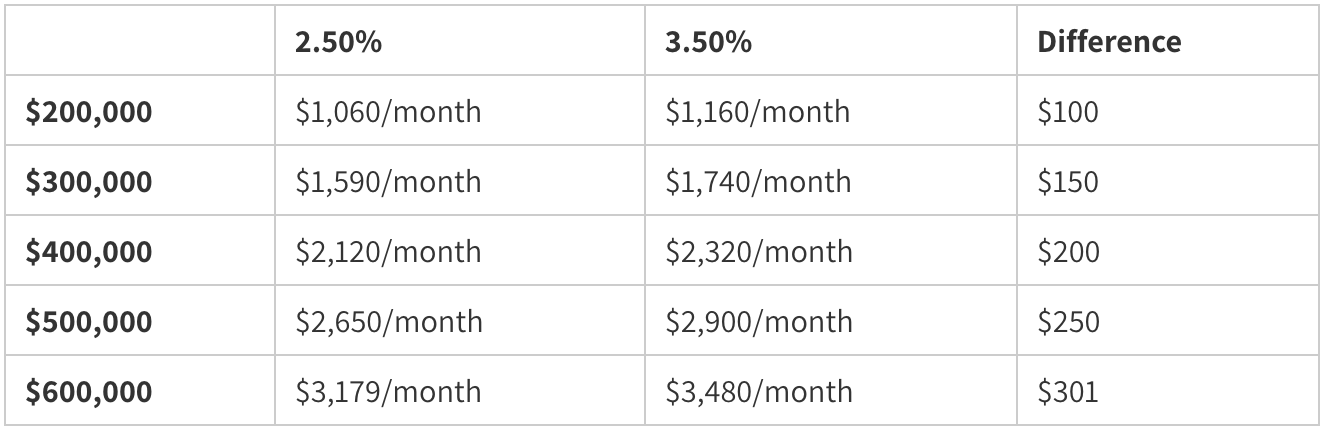

Here’s an example. To keep things simple, the table below shows the difference in monthly repayments on a number of loan balances between a rate of 2.50% and 3.50% (which is just above the current variable rate average).

These figures assume that a borrower is making principal and interest repayments over a loan term of 20 years, and the savings don’t take into account any potential discharge or sign up fees.

This is just part of the story though, because refinancing to a lower rate could save you tens of thousands of dollars in interest over the life of the loan.

So, are you ready to see if you can put money back in your wallet by refinancing to a home loan with a sharper rate?

Spend less time worrying searching for the best home loan. Book a time today!

Source: https://mozo.com.au/home-loans/articles/why-a-1-difference-in-your-home-loan-rate-matters

Watson, T. (2020, October 21).Why a 1% difference in your home loan rate matters. Mozo - The money saving zone - compare and save.https://mozo.com.au/home-loans/articles/why-a-1-difference-in-your-home-loan-rate-matters